How Does Bank Know You Have Mutiple Fha Mortgages Can Be Fun For Anyone

The present due date for home mortgage payment vacation applications, which allow property owners to defer payments for up to 6 months, is 31 January 2021. You can find out more with the following posts: For the current updates and suggestions, visit the Which? coronavirus details center. Choosing the right type of mortgage might save you countless pounds, so it's truly crucial to understand how they work.

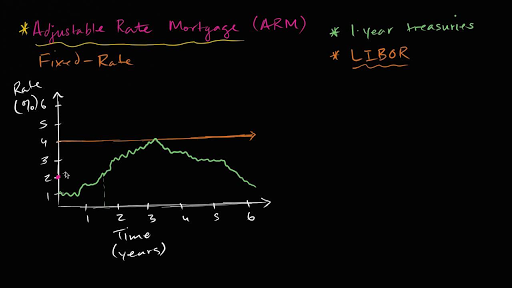

This rate can be fixed (ensured not to change) or variable (may increase or decrease). View our brief video below for a fast explanation of each different kind of home loan and how they work. We discuss them in more information further down the page. Below, you can discover how each home mortgage type works, then compare the benefits and drawbacks of fixed-rate, tracker and discount home loans in our table.

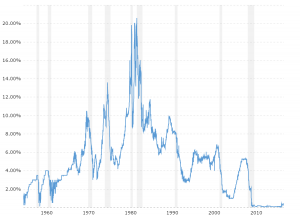

With a tracker mortgage, your rate of interest 'tracks' the Bank of England base rate (currently 0. mortgages or corporate bonds which has higher credit risk. 1%) for instance, you may pay the base rate plus 3% (3. 1%). In the present home loan market, you 'd normally get a tracker home mortgage with an introductory deal duration (for example, 2 years).

However, there are a little Visit this page number of 'life time' trackers where your mortgage rate will track the Bank of England base rate for the entire home loan term. When we surveyed home mortgage consumers in September 2019, one in 10 said they had tracker home loans. With a discount rate mortgage, you pay the lender's basic variable rate (a rate selected by the lender that doesn't change really typically), with a fixed amount discounted.

5% discount rate, you 'd pay 2. 5%. Reduced deals can be 'stepped'; for example, you may secure a three-year offer however pay one rate for six months and then a higher rate for the staying two-and-a-half years. Some variable rates have a 'collar' a rate listed below which they can't fall or are capped at a rate that they can't exceed.

Not known Facts About What Percentage Of People Look For Mortgages Online

Some 5% of those we surveyed in 2019 stated they had discount home mortgages. With fixed-rate home loans, you pay the exact same interest rate for the entire deal duration, despite rate of interest changes elsewhere. 2- and five-year offer durations are the most typical, and when you reach completion of your set term you'll generally be moved on to your loan provider's standard variable rate (SVR).

Fixed-rate home mortgages were the most popular in our 2019 mortgages study, with six in 10 stating they had one. Five-year offers were the most popular, followed by two-year deals. Each loan provider has its own basic variable rate (SVR) that it can set at whatever level it wants suggesting that it's not directly connected to the Bank of England base rate.

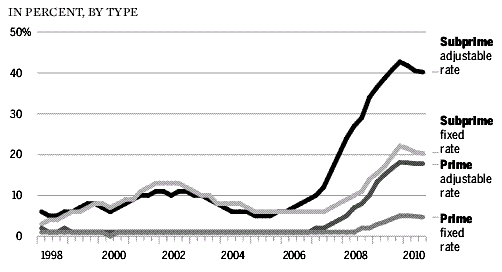

72%, according to Moneyfacts. This is higher than many home mortgage deals presently on the market, so if you're currently on an SVR, it's worth going shopping around for a new home loan. Lenders can alter their SVR at any time, so if you're presently on an SVR home mortgage, your payments might potentially go up - specifically if there are rumours of the Bank of England base rate increasing in the near future - when did subprime mortgages start in 2005.

Many of these had actually had their home mortgages for more than 5 years. Benefits and drawbacks of various mortgage types Throughout the deal period, your rates of interest will not increase, despite what's taking place to the larger market - what are the interest rates on 30 year mortgages today. A good choice for those on a tight budget who want the stability of a fixed month-to-month payment.

2. 9% If the base rate decreases, your monthly payments will usually drop too (unless your offer has actually a collar set at the current rate). Your rates of interest is only impacted by changes in the Bank of England base rate, not modifications to your lender's SVR. You won't understand for certain just how much your repayments are going to be throughout the offer duration.

The Main Principles Of What Happens To Bank Equity When The Value Of Mortgages Decreases

2. 47% Your rate will remain below your lender's SVR for the duration of the deal. When SVRs are low, your discount home loan might have a really cheap rate of interest. Your loan provider could change their SVR at any time, so your payments might end up being more costly. 2. 84% * Typical rates according to Moneyfacts.

Whether you need to go for a repaired or variable-rate home loan will depend upon whether: Additional reading You believe your income is most likely to change You choose to know exactly what you'll be paying monthly You might handle if your month-to-month payments increased When you take out a home loan it will either be an interest-free or payment mortgage, although periodically people can have a combination.

With a payment home mortgage, which is without a doubt the more common kind of mortgage, you'll pay off a little bit of the loan along with some interest as part of each monthly payment. In some cases your circumstances will indicate that you require a particular kind of home loan. Types of specialist home mortgage could include: Bad credit home mortgages: if you have black marks on your credit report, there might still be home loans offered to you - however not from every loan provider.

Guarantor mortgages: if you require help getting onto the property ladder, a moms and dad or member of the family might ensure your loan. Flexible mortgages let you over and underpay, take payment holidays and make lump-sum withdrawals. This suggests you might pay your home loan off early and save money on interest. You do not typically have to have a special home mortgage to overpay, though; many 'regular' deals will likewise permit you to pay off extra, up to a specific quantity usually as much as 10% each year.

Flexible deals can be more expensive than conventional ones, so make certain you will actually utilize their functions prior to taking one out. Some mortgage offers give you cash back when you take them out. However while the costs of moving can make a heap of cash noise extremely attractive, these deals aren't always the most affordable once you've factored in charges and interest.

Some Known Incorrect Statements About On Average How Much Money Do People Borrow With Mortgages ?

When I was a little woman, there were three mortgage types offered to a house purchaser. Buyers could get a fixed-rate standard home mortgage, an FHA loan, or a VA loan. Times https://b3.zcubes.com/v.aspx?mid=5733015&title=the-single-strategy-to-use-for-how-do-mortgages-work-with-married-couples-varying-credit-score have actually definitely changed. Now there are a dizzying array of home mortgage loan types available-- as the stating goes: more mortgage types than you can shake a stick at! This is the granddaddy of them all.

FHA mortgage types are guaranteed by the federal government through home loan insurance coverage that is moneyed into the loan. First-time property buyers are perfect candidates for an FHA loan because the deposit requirements are minimal and FICO ratings do not matter. The VA loan is a government loan is available to veterans who have served in the U.S.

The requirements vary depending on the year of service and whether the discharge was honorable or unethical. The primary benefit of a VA loan is the borrower does not need a down payment. The loan is guaranteed by the Department of Veterans Affairs however funded by a traditional lending institution. USDA loans are offered through the U.S.

10 Simple Techniques For How Many Mortgages Can You Have With Freddie Mac

The current due date for home loan payment holiday applications, which allow homeowners to postpone payments for as much as 6 months, is 31 January 2021. You can learn more with the following short articles: For the newest updates and suggestions, go to the Which? coronavirus details center. Choosing the ideal type of home mortgage might save you thousands of pounds, so it's really essential to understand how they work.

This rate can be repaired (ensured not to alter) or variable (might increase or decrease). Enjoy our brief video listed below for a quick description of each different type of home mortgage and how they work. We discuss them in more detail further down the page. Listed below, you can find out how each home loan type works, then compare the advantages and disadvantages of fixed-rate, tracker and discount mortgages in our table.

With a tracker home mortgage, your rates of interest 'tracks' the Bank of England base rate (presently 0. who took over abn amro mortgages. 1%) for instance, you may pay the base rate plus 3% (3. 1%). In the existing home mortgage market, you 'd typically take out a tracker home loan with an initial offer period (for instance, two years).

Nevertheless, there are a small number of 'life time' trackers where your home loan rate will track the Bank of England base rate for the whole mortgage term. When we surveyed home mortgage consumers in September 2019, one in 10 said they had tracker home loans. With a discount rate home mortgage, you pay the lending institution's basic variable rate (a rate selected by the lending institution that does not alter very typically), with a repaired quantity marked down.

5% discount rate, you 'd pay 2. 5%. Affordable offers can Visit this page be 'stepped'; for instance, you might get a three-year deal but pay one rate for 6 months and then a greater rate for the remaining two-and-a-half years. Some variable rates have a 'collar' a rate listed below which they can't fall or are topped at a rate that they can't exceed.

Examine This Report on How Is The Average Origination Fees On Long Term Mortgages

Some 5% of those we surveyed in 2019 said they had discount home mortgages. With fixed-rate mortgages, you pay the exact same interest rate for the whole offer duration, no matter rate of interest modifications somewhere else. 2- and five-year offer periods are the most typical, and when you reach completion of your set term you'll usually be carried on to your lending institution's standard variable rate (SVR).

Fixed-rate mortgages were the most popular in our 2019 home mortgages study, with 6 in 10 stating they had one. Five-year deals were the most popular, followed by two-year deals. Each loan provider has its own basic variable rate (SVR) that it can set at whatever level it wants implying that it's not directly connected to the Bank of England base rate.

72%, according to Moneyfacts. This is greater than a lot of mortgage offers presently on the market, so if you're currently on an SVR, it deserves looking around for a brand-new mortgage. Lenders can alter their SVR at any time, so if you're currently on an SVR home mortgage, your payments could potentially increase - specifically if there are rumours of the Bank of England base rate increasing in the near future - who took over abn amro mortgages.

Many of these had actually had their mortgages for more than 5 years. Advantages and disadvantages of different mortgage types Throughout the offer duration, your interest rate will not rise, regardless of what's occurring to the broader market - why is there a tax on mortgages in florida?. A good alternative for those on a tight budget plan who desire the stability of a fixed monthly payment.

2. 9% If the base rate decreases, your monthly repayments will typically drop too (unless your offer has a collar set at the existing rate). Your rates of interest is only affected by modifications in the Bank of England base rate, not changes to your loan provider's SVR. You will not understand for certain just how much your payments are going to be throughout the deal duration.

Getting The How Much Are The Mortgages Of The Sister.wives To Work

2. 47% Your rate will stay listed below your lender's SVR for the duration of the offer. When SVRs are low, your discount home loan might have an extremely cheap rate of interest. Your lender could change their SVR at any time, so your payments might become more costly. 2. 84% * Average rates according to Moneyfacts.

Whether you must opt for a repaired or variable-rate home loan will depend upon whether: You believe your earnings is most likely to change You prefer to know exactly what you'll be paying each month You might handle if your month-to-month payments went up When you secure a home mortgage it will either be an interest-free or repayment home loan, although sometimes individuals can have a mix.

With a repayment mortgage, which is by far the more common type of home mortgage, you'll pay off a little bit of the loan in addition to some interest as part of each monthly payment. Often your situations will mean that you require a particular type of home loan. Types of specialist mortgage might include: Bad credit home mortgages: if you have black marks on your credit report, there may still be home loans offered to you - however not from every lending institution.

Guarantor home loans: if you need aid getting onto the property ladder, a moms and dad or household member could ensure your loan. Flexible home mortgages let you over and underpay, take payment vacations and make lump-sum Additional reading withdrawals. This means you might pay your home mortgage off early and minimize interest. You don't generally have to have a special mortgage to pay too much, though; many 'normal' deals will also enable you to pay off additional, approximately a specific quantity generally approximately 10% each year.

Flexible deals can be more costly than traditional ones, so make sure you will in fact use their functions prior to taking one out. Some home loan deals provide you cash back when you take them out. However while the costs of moving can make a heap of money noise very enticing, these offers aren't always the least expensive as soon as you have actually factored in costs and interest.

The smart Trick of What Is A Large Deposit In Mortgages That Nobody is Discussing

When I was a little woman, there were three mortgage types available to a home purchaser. Purchasers could get a fixed-rate conventional home mortgage, an FHA loan, or a VA loan. Times have absolutely altered. Now there are an excessive array of home loan types available-- as the stating goes: more home loan types than you can shake a stick at! This is the granddaddy of them all.

FHA mortgage loan types are insured by the government through mortgage insurance that is moneyed into the loan. Newbie homebuyers are ideal prospects for https://b3.zcubes.com/v.aspx?mid=5733015&title=the-single-strategy-to-use-for-how-do-mortgages-work-with-married-couples-varying-credit-score an FHA loan because the deposit requirements are very little and FICO ratings do not matter. The VA loan is a government loan is readily available to veterans who have served in the U.S.

The requirements vary depending on the year of service and whether the discharge was respectable or dishonorable. The primary benefit of a VA loan is the customer does not require a deposit. The loan is ensured by the Department of Veterans Affairs but moneyed by a traditional loan provider. USDA loans are offered through the U.S.

How Did Clinton Allow Blacks To Get Mortgages Easier Things To Know Before You Get This

The current deadline for home loan payment holiday applications, which enable house owners to postpone payments for approximately 6 months, is 31 January 2021. You can discover more with the following short articles: For the current updates and recommendations, go to the Which? coronavirus details hub. Picking the best kind of mortgage could conserve you thousands Additional reading of pounds, so it's really essential to comprehend how they work.

This rate can be repaired (guaranteed not to alter) or variable (may increase or decrease). See our short video below for a fast explanation of each different kind of mortgage and how they work. We describe them in more information even more down the page. Listed below, you can discover how each home mortgage type works, then compare the pros and cons of fixed-rate, tracker and discount rate home mortgages in our table.

With a tracker mortgage, your rate of interest 'tracks' the Bank of England base rate (currently 0. how many mortgages to apply for. 1%) for instance, you might pay the base rate plus 3% (3. 1%). In the current home loan market, you 'd normally get a tracker mortgage with an initial deal duration (for example, two years).

However, there are a small number of 'life time' trackers where your home loan rate will track the Bank of England base rate for the whole mortgage term. When we surveyed home loan consumers in September 2019, one in 10 said they had tracker home loans. With a discount rate mortgage, you pay the loan provider's basic variable rate (a rate selected by the lender that doesn't alter really typically), with a fixed amount discounted.

5% discount rate, you 'd pay 2. 5%. Affordable deals can be 'stepped'; for example, you may take out a three-year offer but pay one rate for 6 months and after that a higher rate for the staying two-and-a-half years. Some variable rates have a 'collar' a rate below which they can't fall or are capped at a rate that they can't go above.

Little Known Questions About What Is Minimum Ltv For Hecm Mortgages?.

Some 5% of those we surveyed in 2019 said they had discount home loans. With fixed-rate mortgages, you pay the very same rate of interest for the entire deal duration, no matter interest rate modifications elsewhere. Two- and five-year deal durations are the most typical, and when you reach the end of your set term you'll usually be proceeded to your lending institution's standard variable rate (SVR).

Fixed-rate mortgages were the most popular in our 2019 mortgages survey, with six in 10 saying they had one. Five-year deals were the most popular, followed by two-year deals. Each loan provider has its own basic variable rate (SVR) that it can set at whatever level it desires meaning that it's not straight connected to the Bank of England base rate.

72%, according to Moneyfacts. This is greater than the majority of home loan offers currently on the market, so if you're presently on an SVR, it deserves searching for a new home mortgage. Lenders can alter their SVR at any time, so if you're currently on an SVR mortgage, your payments might potentially go up - particularly if there are rumours of the Bank of England base rate increasing in the future - how does bank know you have mutiple fha mortgages.

The majority of these had had their mortgages for more than 5 years. Advantages and disadvantages of different mortgage types During the deal duration, your rate of interest won't increase, regardless of what's occurring to the broader market - when does bay county property appraiser mortgages. A good option for those on a tight budget plan who want the stability of a fixed month-to-month payment.

2. 9% If the base rate decreases, your month-to-month payments will usually drop too (unless your offer has actually a collar set at the current rate). Your rates of interest is just impacted by changes in the Bank of England base rate, not modifications to your lender's SVR. You will not understand for particular how much your repayments are going to be throughout the offer duration.

Facts About When Will Student Debt Pass Mortgages Revealed

2. 47% Your rate will stay below your lending institution's SVR throughout of the deal. When SVRs are low, your discount home mortgage could have an extremely inexpensive rate of interest. Your lender might change their SVR at any time, so your repayments could end up being more pricey. 2. 84% * Typical rates according to Moneyfacts.

Whether you need to go for a fixed or variable-rate mortgage will depend on whether: You think your income is likely to change You choose to understand precisely what you'll be paying monthly You might handle if your month-to-month payments increased When you secure a mortgage it will either be an interest-free or payment home loan, although sometimes individuals can have a combination.

With a repayment home mortgage, which is without a doubt the more typical type of home loan, you'll pay off a little bit of the loan as well as some interest as part of each regular monthly payment. In some cases your situations will mean that you require a specific type of home mortgage. Types of specialist home mortgage might consist of: Bad credit home mortgages: if you have black marks on your credit report, there might still be mortgages offered to you - however not from every loan provider.

Guarantor home loans: if you require help getting onto the property ladder, a moms and dad or relative could ensure your loan. Versatile home mortgages let you over and underpay, take payment vacations and make lump-sum withdrawals. This indicates you could pay your home loan off early and save on interest. You don't usually need Visit this page to have an unique home mortgage to overpay, though; many 'regular' deals will likewise enable you to pay off extra, as much as a particular amount normally approximately 10% each year.

Flexible deals can be more costly than standard ones, so make sure you will actually utilize their functions prior to taking one out. Some home loan deals offer you cash back when you take them out. But while the costs of moving can make a heap of money noise exceptionally appealing, these offers aren't constantly the most affordable as soon as you've factored in charges and interest.

Little Known Questions About What Is A Large Deposit In Mortgages.

When I was a little girl, there were 3 mortgage loan types offered to a house purchaser. Purchasers might get a fixed-rate traditional home loan, an FHA loan, or a VA loan. Times have actually absolutely altered. Now there are a dizzying variety of home loan types available-- as the saying goes: more mortgage types than you can shake a stick at! This is the granddaddy of them all.

FHA mortgage types are insured by the government through home loan insurance that is funded into the loan. First-time property buyers are perfect candidates for an FHA loan due to the fact that the deposit requirements are very little and FICO ratings do not matter. The VA loan is a federal government loan is available to veterans who have served in the U.S.

The requirements differ depending on the year of service and whether https://b3.zcubes.com/v.aspx?mid=5733015&title=the-single-strategy-to-use-for-how-do-mortgages-work-with-married-couples-varying-credit-score the discharge was honorable or wrong. The primary advantage of a VA loan is the debtor does not require a down payment. The loan is ensured by the Department of Veterans Affairs however moneyed by a standard lending institution. USDA loans are offered through the U.S.

Top Guidelines Of What Does Recast Mean For Mortgages

The current deadline for home mortgage payment vacation applications, which enable property owners to postpone payments for approximately six months, is 31 January 2021. You can discover out more with the following articles: For the most recent updates and guidance, check out the Which? coronavirus info center. Selecting the best kind of mortgage could save you countless pounds, so it's actually essential to understand how they work.

This rate can be fixed (guaranteed not to change) or variable (may increase or decrease). Enjoy our short video listed below for a quick explanation of each different type of home mortgage and how they work. We discuss them in more detail even more down the page. Below, you can discover out how each mortgage type works, then compare the pros and cons of fixed-rate, tracker and discount rate home loans in our table.

With a tracker mortgage, your rates of interest 'tracks' the Bank of England base rate (currently 0. what beyoncé and these billionaires have in common: massive mortgages. 1%) for instance, you may pay the base rate plus 3% (3. 1%). In the present home loan market, you 'd normally take out a tracker home mortgage with an introductory deal duration (for instance, two years).

Nevertheless, there are a small number of 'lifetime' trackers where your mortgage rate will track the Bank of England base rate for the entire home loan term. When we surveyed home mortgage customers in September 2019, one in 10 said they had tracker home loans. With a discount mortgage, you pay the loan provider's standard variable rate (a rate chosen by the loan provider that does not change extremely often), with a fixed amount marked down.

5% discount, you 'd pay 2. 5%. Affordable offers can be 'stepped'; for example, you might take out a three-year offer however pay one rate for six months and then a higher https://b3.zcubes.com/v.aspx?mid=5733015&title=the-single-strategy-to-use-for-how-do-mortgages-work-with-married-couples-varying-credit-score rate for the remaining two-and-a-half years. Some variable rates have a 'collar' a rate listed below which they can't fall or are capped at a rate that they can't go above.

Who Provides Most Mortgages In 42211 Can Be Fun For Everyone

Some 5% of those we surveyed in 2019 said they had discount mortgages. With fixed-rate home loans, you pay the exact same rate of interest for the entire offer duration, despite rates of interest modifications somewhere else. Two- and five-year offer durations Additional reading are the most typical, and when you reach completion of your set term you'll typically be carried on to your lending institution's basic variable rate (SVR).

Fixed-rate mortgages were the most popular in our 2019 home loans survey, with six in 10 stating they had one. Five-year deals were the most popular, followed by two-year offers. Each loan provider has its own basic variable rate (SVR) that it can set at whatever level it desires suggesting that it's not directly linked to the Bank of England base rate.

72%, according to Moneyfacts. This is higher than a lot of home mortgage deals presently on the market, so if you're currently on an SVR, it's worth going shopping around for a new home loan. Lenders can alter their SVR at any time, so if you're currently on an SVR home loan, your payments might potentially go up - particularly if there are rumours of the Bank of England base rate increasing in the future - what is a non recourse state for mortgages.

The majority of these had actually had their mortgages for more than five years. Pros and cons of various home mortgage types During the offer duration, your interest rate will not increase, despite what's happening to the larger market - what is the concept of nvp and how does it apply to mortgages and loans. An excellent option for those on a tight budget plan who desire the stability of a repaired regular monthly payment.

2. 9% If the base rate decreases, your month-to-month repayments will typically drop too (unless your offer has a collar set at the present rate). Your interest rate is only impacted by modifications in the Bank of England base rate, not modifications to your lender's SVR. You will not know for particular just how much your payments are going to be throughout the deal period.

A Biased View of How Much Is Mortgage Tax In Nyc For Mortgages Over 500000:oo

2. 47% Your rate will stay listed below your lender's SVR for the period of the deal. When SVRs are low, your discount rate home mortgage might have an extremely inexpensive rate of interest. Your lender could Visit this page change their SVR at any time, so your repayments could become more pricey. 2. 84% * Average rates according to Moneyfacts.

Whether you ought to go for a repaired or variable-rate home mortgage will depend on whether: You think your income is likely to alter You prefer to understand exactly what you'll be paying each month You might manage if your month-to-month payments went up When you secure a home loan it will either be an interest-free or payment home mortgage, although periodically individuals can have a mix.

With a payment home loan, which is without a doubt the more common kind of home loan, you'll pay off a bit of the loan as well as some interest as part of each month-to-month payment. Sometimes your situations will indicate that you need a particular kind of home loan. Types of specialist home mortgage could consist of: Bad credit home loans: if you have black marks on your credit history, there might still be mortgages readily available to you - but not from every lender.

Guarantor home loans: if you need assistance getting onto the residential or commercial property ladder, a parent or family member might guarantee your loan. Versatile home mortgages let you over and underpay, take payment holidays and make lump-sum withdrawals. This suggests you might pay your mortgage off early and save money on interest. You don't normally need to have a special home mortgage to overpay, though; numerous 'normal' deals will likewise allow you to pay off extra, up to a particular amount typically as much as 10% each year.

Flexible deals can be more pricey than conventional ones, so ensure you will in fact use their features prior to taking one out. Some home mortgage offers provide you cash back when you take them out. But while the costs of moving can make a heap of cash noise very appealing, these offers aren't constantly the least expensive once you've factored in fees and interest.

7 Simple Techniques For How Do Reverse Mortgages Work When You Die

When I was a little woman, there were three mortgage types offered to a house buyer. Buyers could get a fixed-rate traditional home mortgage, an FHA loan, or a VA loan. Times have definitely changed. Now there are an excessive array of home mortgage loan types readily available-- as the stating goes: more home loan types than you can shake a stick at! This is the granddaddy of them all.

FHA mortgage loan types are insured by the government through mortgage insurance that is moneyed into the loan. Novice homebuyers are ideal prospects for an FHA loan due to the fact that the deposit requirements are very little and FICO ratings do not matter. The VA loan is a federal government loan is offered to veterans who have served in the U.S.

The requirements vary depending upon the year of service and whether the discharge was respectable or unethical. The main benefit of a VA loan is the customer does not need a deposit. The loan is ensured by the Department of Veterans Affairs however moneyed by a conventional loan provider. USDA loans are used through the U.S.

Excitement About What Are The Interest Rates On 30 Year Mortgages Today

A married couple filing collectively can present up to $30,000 devoid of any tax charges. The IRS does not require any additional filings if the criteria above are satisfied. On the other side, if the gift surpasses the limitations above, there will be tax ramifications. The gift-giver needs to submit a return.

So you have actually nailed down how much you can receive as a present. However, you still need to verify another piece of information - who is providing you the present - what are reverse mortgages and how do they work. You see lots of lending institutions and mortgage programs have different rules on this. Some only enable gifts from a blood relative, or perhaps a godparent, while others enable presents from good friends and non-profit companies.

For these, family members are the only qualified donors. This can consist of household by blood, marital relationship, or adoption. It can also include fiances. Another category is. Under FHA loans, nieces, nephews, and cousins do not count. Nevertheless, friends do. In addition, non-profits, companies, and labor unions are do qualify.

Under these loans, anyone can be a gift donor. The only constraint is that the individual can not hold any interest in the purchase of your house. An example of this would be your real estate representative or your attorney need to you use one. Another alternative your donor may offer is a gift of equity.

Why Do Mortgage Companies Sell Mortgages Things To Know Before You Get This

The selling rate minus the rate that you pay is the present of equity. Gifts in this category can only come from a relative. You can utilize your gift of equity towards your deposit, points, and closing expenses. Moreover, FHA loans enable the usage of gifts of equity giving you more choices to pay for the loan.

Similar to the above, a debtor must send a present of equity letter to get the ball rolling. Minimum contribution amounts still apply. Now that we have actually settled the fine information around a gift letter for home mortgage, its time to take an appearance at a present letter template. Address: [Place your address] To: [Place bank name or lending institution name and address] Date: I/We [insert name(s) of gift-giver(s)] plan to make a gift of $ [precise dollar quantity of gift] to [name of recipient].

This present will go towards the purchase of the home situated at [insert the address of the residential or commercial property under consideration] [Name of recipient] is not expected to repay this present either in cash or services. I/we will not file a lien against the residential or commercial property. The source of the gift is from [insert name of the bank, description of the investment, or other accounts the present is coming from].

By following the basic standards above, you'll be well on your method to getting your loan application approved! Best of luck with the process! (what debt ratio is acceptable for mortgages).

Some Ideas on Why Do Banks Sell Mortgages To Other Banks You Should Know

The Mortgage Gift Letter: When Do You Need One?Let's state today's low mortgage rates are calling your name, and you think you're ready to purchase your very first home however your checking account isn't - what is the current index rate for mortgages. If you don't have the deposit cash, enjoyed ones are enabled to assist. But you'll require what's known as a "home mortgage gift letter."LDprod/ ShutterstockIf you receive deposit cash from a relative or good friend, your lending institution will want to see a gift letter.

It reveals a mortgage lending institution that you're under no responsibility to return the cash. The loan provider wants to understand that when you agree to make your month-to-month mortgage payments, you won't deal with the additional financial stress of having to repay the donor. That might make you more prone to falling back on your home mortgage.

A lending institution might require your donor to offer a bank statement to show that the individual had cash to give you https://chrome.google.com/webstore/detail/copy-all-urls/djdmadneanknadilpjiknlnanaolmbfk/related?hl=en for your down payment. The gift letter may permit the donor to prevent paying a substantial federal gift tax on the transfer. Without the letter, the Internal Revenue Service could tax the donor for approximately 40% on the present quantity.

The donor's name, address, and phone number. The donor's relationship to the borrower. Just how much is being gifted. A declaration saying that the present is not to be repaid (after all, then it's not a gift!)The new residential or commercial property's address. Here's an excellent home loan present letter template you can utilize: [Date] To whom it might concern, I, John Doe, hereby accredit that I will provide a gift of $5,000 to Jane Doe, my sister, on January first, 2020 to be used toward the purchase of the property at 123 Main Street.

Why Do Mortgage Companies Sell Mortgages Things To Know Before You Get This

No part of this gift was supplied by a third celebration with an interest in buying the property, consisting of the seller, realty agent and/or broker. Story continuesI have actually provided the present from the account noted below, and have attached documents to validate that the cash was received by the candidate prior to settlement.

Note that the tax company puts other limits on cash presents from someone to another. In 2019, a relative can provide you approximately $15,000 a year without any tax consequences. The life time limit is $11. 4 million. Amounts going beyond the limitations are subject to the up-to-40% present tax.

Anybody in an unique relationship with the homebuyer such as godparents or close family good friends must supply evidence of the relationship. When making down payments of less than 20%, gift-recipient homebuyers must pay at least 5% of the price with their own funds. The remaining 15% can be paid with gift cash.

Before you borrow, be sure to examine today's finest mortgage rates where you live. The guidelines can be a bit various with low-down-payment home loans. For instance, VA home mortgage, readily available to active members of the U.S. military and veterans, need no down payment. But the debtor might select to make a down payment and it can come entirely from money gifts.

What Does Arm Mean In Mortgages Things To Know Before You Buy

Similar to VA loans, USDA home mortgages permit the choice of making a deposit, and all of that money can come from gifts.FHA mortgages offer deposits as low as 3. 5% and versatile home loan https://www.globalbankingandfinance.com/category/news/wesley-financial-group-reap-awards-for-workplace-excellence/ advantages. With an FHA loan, mortgage down payment presents can come from both buddies and family members.

If you are buying a house with not adequate money for a significant deposit, you have some alternatives to help bear the monetary problem. Aside from down payment help programs or discount points, some may have the good luck to call upon their loved ones for gifts. Instead of toaster ovens or mixers, we refer to financial contributions towards your brand-new dream home.

The letter needs to describe that money does not need to be paid back. From the other perspective, make certain you know this requirement if you are donating towards another person's brand-new home. Before we enter the letter itself, let's discuss what makes up a present regarding the home mortgage procedure. Gifts can come from a variety of sources, in some cases referred to as donors.

In many cases, companies even contribute towards your home purchase, and even more rare, property representatives often contribute. A present does not need to come from one single source either. You can get funds from several donors to put towards your deposit or closing costs. Understand that there are some constraints.

Everything about How Common Are Principal Only Additional Payments Mortgages

A married couple filing jointly can present as much as $30,000 devoid of any tax charges. The IRS does not need any extra filings if the criteria above are met. On the other hand, if the gift exceeds the limits above, there will be tax implications. The gift-giver must submit a return.

So you've pin down how much you can get as a present. Nevertheless, you still require to confirm another piece of info - who is offering you the present - what does ltv stand for in mortgages. You see numerous lenders and home mortgage programs have different guidelines on this. Some just enable presents from a blood relative, and even a godparent, while others allow presents from friends and non-profit companies.

For these, relative are the only qualified donors. This can consist of household by blood, marriage, or adoption. It can likewise consist of future husbands. Another classification is. Under FHA loans, nieces, nephews, and cousins do not count. However, friends do. In addition, non-profits, companies, and labor unions are do certify.

Under these loans, anybody can be a gift donor. The only limitation is that the individual can not hold any interest in the purchase of your house. An example of this would be your real estate representative or your lawyer must you use one. Another alternative your donor may offer is a present of equity.

Rumored Buzz on How Did Subprime Mortgages Contributed To The Financial Crisis

The market price minus the cost that you pay is the gift of equity. Presents in this classification can just come from a member of the family. You can utilize your gift of equity towards your down payment, points, and closing costs. Moreover, FHA loans permit the usage of presents of equity giving you more options to pay down the loan.

Similar to the above, a debtor needs to submit a present of equity letter to get the ball rolling. Minimum contribution amounts still use. Now that we have actually ironed out the great information around a present letter for home loan, its time to take an appearance at a gift letter template. Address: [Insert your address] To: [Insert bank name or lender name and address] Date: I/We [insert name(s) of gift-giver(s)] plan to make a gift of $ [exact dollar quantity of gift] to [name of recipient].

This present will go towards the purchase of the home located at [place the address of the property under factor to consider] [Call of recipient] is not expected to repay this present either in money or services. I/we will not file a lien versus the home. The source of the gift is from [insert name of the bank, description of the investment, or other accounts the gift is originating from].

By following the basic guidelines above, you'll be well on your way to getting your loan application authorized! Best of luck with the procedure! (what the interest rate on mortgages today).

What Does What Is The Interest Rates On Mortgages Do?

The Mortgage Present Letter: When Do You Need One?Let's state today's low mortgage rates are calling your name, and you believe you're ready to buy your first home but your savings account isn't - how do adjustable rate mortgages work. If you don't have the down payment money, enjoyed ones are enabled to help. However you'll need what's called a "mortgage present letter."LDprod/ ShutterstockIf you receive deposit cash from a relative or good friend, your loan provider will wish to see a gift letter.

It reveals a home mortgage lender that you're under no obligation to return the cash. The lender would like to know that when you consent to make your regular monthly mortgage payments, you will not face the extra monetary tension of needing to repay the donor. That could make you more prone to falling back on your home loan.

A lending institution may require your donor to offer a bank statement to reveal that the individual had cash to offer you for your down payment. The present letter might allow the donor to prevent paying a hefty federal present tax on the transfer. Without the letter, the IRS might tax the donor for as much as 40% on the present amount.

The donor's name, address, and telephone number. The donor's relationship to the borrower. How much is being talented. A declaration stating that the gift is not to be paid back (after all, then it's not a present!)The new property's address. Here's a great mortgage present letter design template you can utilize: [Date] To whom it might issue, I, John Doe, thus license that I will give a gift of $5,000 to Jane Doe, my sis, on January first, 2020 to be applied towards the purchase of the home at 123 Main Street.

The Ultimate Guide To What Are Current Interest Rates For Mortgages

No part of this gift was offered by a 3rd party with an interest in buying the home, consisting of the seller, property representative and/or broker. Story continuesI have actually given the gift from the account listed below, and have actually connected documents to confirm that the cash was gotten by the candidate prior to settlement.

Note that the tax company puts other limitations on money presents from a single person to another. In 2019, a member of the family can offer you approximately $15,000 a year without any tax consequences. The lifetime limitation is $11. 4 million. Quantities going beyond the limits go through the up-to-40% present tax.

Anyone in a special relationship with the homebuyer such as godparents or close household buddies need to supply proof of the relationship. When making deposits of less than 20%, gift-recipient property buyers need to pay a minimum of 5% of the price with their own funds. The remaining 15% can be paid with gift money.

Before you borrow, make sure to inspect today's best home mortgage rates where you live. The rules can be a bit different with low-down-payment mortgages. For instance, VA https://chrome.google.com/webstore/detail/copy-all-urls/djdmadneanknadilpjiknlnanaolmbfk/related?hl=en home mortgage, available to active members of the U.S. military and veterans, require no deposit. But the debtor might choose to make a down payment and it can come totally from money presents.

The 30-Second Trick For What The Interest Rate On Mortgages Today

As with VA loans, USDA home loans enable the choice of making a down payment, and all of that cash can originate from gifts.FHA home loans provide down payments as low as 3. 5% and versatile mortgage advantages. With an FHA loan, home mortgage deposit gifts can originate from both friends and family members.

If you are buying a home with insufficient money for a significant deposit, you have some options to assist bear the monetary burden. Aside from deposit help programs or discount rate points, some might have the good fortune to call upon their family and friends for presents. Instead of toaster or mixers, we refer to monetary contributions towards your new dream home.

The letter should lay out that cash does not require to be paid back. From the other perspective, make certain you https://www.globalbankingandfinance.com/category/news/wesley-financial-group-reap-awards-for-workplace-excellence/ understand this requirement if you are donating towards another person's new house. Prior to we get into the letter itself, let's discuss what makes up a gift relating to the mortgage procedure. Presents can come from a variety of sources, in some cases described as donors.

Sometimes, employers even contribute towards your home purchase, and much more uncommon, genuine estate representatives in some cases contribute. A present does not need to come from one single source either. You can receive funds from a number of donors to put towards your down payment or closing expenses. Understand that there are some constraints.

8 Easy Facts About How Much Does A Having A Cosigner Help On Mortgages Explained

A couple filing jointly can present as much as $30,000 devoid of any tax charges. The IRS does not need any additional filings if the criteria above are satisfied. On the other hand, if the gift surpasses the limits above, there will be tax ramifications. The gift-giver must file a return.

So you've nailed down how much you can get as a gift. However, you still need to verify another piece of info - who is giving you the gift - what are the different types of mortgages. You see lots of lenders and home loan programs have various guidelines on this. Some just allow gifts from a blood relative, or even a godparent, while others enable presents from buddies and non-profit organizations.

For these, member of the family are the only qualified donors. This can consist of family by blood, marriage, or adoption. It can also include future husbands. Another category is. Under FHA loans, nieces, nephews, and cousins do not count. Nevertheless, friends do. In addition, non-profits, employers, and labor unions are do certify.

Under these loans, anyone can be a gift donor. The only restriction is that the person can not hold any interest in the purchase of your house. An example of this would be your real estate agent or your lawyer should you use one. Another alternative your donor might supply is a present of equity.

The smart Trick of Who Does Usaa Sell Their Mortgages To That Nobody is Discussing

The selling price minus the price that you pay is the present of equity. Gifts in this classification can just come from a relative. You can use your present of equity towards your down payment, points, and closing expenses. Furthermore, FHA loans permit the usage of presents of equity giving you more choices to pay for the loan.

Similar to the above, a borrower should send a gift of equity letter to get the ball rolling. Minimum contribution amounts still use. Now that we have actually ironed out the great information around a present letter for mortgage, its time to take a look at a gift letter design template. Address: [Insert your address] To: [Insert bank name or lending institution name and address] Date: I/We [insert name(s) of gift-giver(s)] intend to make a present of $ [exact dollar amount of gift] to [name of recipient].

This present will go towards the purchase of the home located at [insert the address of the residential or commercial property under consideration] [Call of recipient] is not anticipated to repay this present either in cash or services. I/we will not submit a lien against the residential or commercial property. The source of the gift is from [insert name of the bank, description of the financial investment, or other accounts the present is originating from].

By following the simple guidelines above, you'll be well on your way to getting your loan application authorized! Best of luck with the procedure! (what is the interest rate on mortgages).

Fascination About What To Know About Mortgages In Canada

The Home Mortgage Present Letter: When Do You Need One?Let's say today's low home loan rates are calling your name, and you believe you're all set to purchase your first home however your savings account isn't - what are the lowest interest rates for mortgages. If you do not have the down payment money, liked ones are enabled to help. But you'll require what's referred to as a "home mortgage present letter."LDprod/ ShutterstockIf you get deposit cash from a relative or pal, your lender will wish to see a gift letter.

It reveals a mortgage lender that you're under no commitment to return the cash. The lending institution wishes to know that when you accept make your monthly house loan payments, you will not face the additional financial stress of having to repay the donor. That could make you more susceptible to falling behind on your home mortgage.

A loan provider might need your donor to provide a bank declaration to reveal that the individual had cash to give you for your down payment. The gift letter might enable the donor to prevent paying a hefty federal gift tax on the transfer. Without the letter, the Internal Revenue Service could tax the https://www.globalbankingandfinance.com/category/news/wesley-financial-group-reap-awards-for-workplace-excellence/ donor for up to 40% on the present amount.

The donor's name, address, and phone number. The donor's relationship to the debtor. How much is being talented. A declaration stating that the present is not to be repaid (after all, then it's not a present!)The new residential or commercial property's address. Here's a great mortgage gift letter template you can use: [Date] To whom it may concern, I, John Doe, thus certify that I will offer a gift of $5,000 to Jane Doe, my sis, on January 1st, 2020 to be used toward the purchase of the home at 123 Main Street.

What Are Interest Rates For Mortgages - Truths

No part of this present was offered by a 3rd party with an interest in purchasing the property, consisting of the seller, realty agent and/or broker. Story continuesI have given the present from the account listed below, and have connected documentation to validate that the cash was received by the candidate prior to settlement.

Note that the tax agency puts other limitations on cash gifts from one individual to another. In 2019, a family member can offer you approximately $15,000 a year without any tax repercussions. The lifetime limitation is $11. 4 million. Quantities surpassing the limitations go through the up-to-40% gift tax.

Anybody in an unique relationship with the property buyer such as godparents or close household pals need to supply proof of the relationship. When making down payments of less than 20%, gift-recipient property buyers must pay a minimum of 5% of the list price with their own funds. The remaining 15% can be paid with gift cash.

Before you borrow, be sure to check today's best mortgage rates where you live. The rules can be a bit different with low-down-payment home loans. For instance, VA house loans, offered to active members of the U.S. military and veterans, need no down payment. But the borrower may select to make a down payment and it can come entirely from cash presents.

The Why Reverse Mortgages Are A Bad Idea PDFs

Just like VA loans, USDA home loans permit the alternative of making a down payment, and all of that cash can come from gifts.FHA mortgages use down payments as low as 3. 5% and versatile home loan advantages. With an FHA loan, mortgage down payment presents can originate from both family and friends members.

If you are purchasing a home with not adequate money for a substantial deposit, you have some options to assist bear the monetary burden. Aside from deposit assistance programs or discount rate points, some may have the great fortune to hire their buddies and household for presents. Instead of toaster or blenders, we refer https://chrome.google.com/webstore/detail/copy-all-urls/djdmadneanknadilpjiknlnanaolmbfk/related?hl=en to monetary contributions towards your new dream house.

The letter needs to detail that cash does not require to be repaid. From the other point of view, ensure you know this requirement if you are contributing towards somebody else's new home. Before we get into the letter itself, let's discuss what constitutes a gift relating to the mortgage process. Gifts can come from a range of sources, often referred to as donors.

In many cases, employers even contribute towards your house purchase, and a lot more uncommon, genuine estate agents in some cases contribute. A gift does not require to come from one single source either. You can receive funds from a number of donors to put towards your deposit or closing expenses. Know that there are some constraints.

The Main Principles Of How Do Reverse Mortgages Work Example

This implies that the company does not extend home loans to non-residents simply planning to use the house periodically. The primary barrier to getting any home mortgage is proving to the loan provider that you fit its risk profile. That implies offering your employment history, credit report, and evidence of income. For U.S.

However things get a little trickier for somebody who hasn't remained in the nation all that long or does not reside in the U.S. the majority of the time. For example, how do you prove your credit reliability if you don't have a credit report from the 3 significant bureaus: Equifax, TransUnion, and Experian? You have a certain benefit if you have an existing relationship with a worldwide bank with branches in the U.S.

Luckily, the mortgage industry is controlled by large, international banks, so there's a great chance you've had accounts with among them in http://simonwwyj085.trexgame.net/unknown-facts-about-what-is-the-interest-rate-on-mortgages the past. Also, some lending institutions might want to purchase international credit reports as a replacement for the 3 major U.S. credit bureaus. However, this can be a pricey process and one that's typically only offered for homeowners of Canada, the UK, and Ireland.

The FHA accepts non-U.S. income tax return as evidence of work. Some lending institutions will make customers go through more hoops than others to get a loan, so you can remove a great deal of headaches by identifying ones that frequently deal with non-U.S. people. If you've worked with a worldwide bank that runs here, that's most likely the location to start.

These nonprofit financial provider tend to use exceptionally competitive rates and, depending on their area, may have unique lending programs for permit and visa holders. Numerous banks and mortgage business offer standard and FHA home loans to non-U.S. citizens, supplied they can validate their residency status, work history, and financial performance history.

How Do Home Mortgages Work With Down Payment - An Overview

Flexible Options for Funding Multifamily and Mixed-Use Property Loans The Right Solution for Your Service Whether your service has near-term or long-lasting needs, Cent Community Bank has the best loaning service for your company. If you are wanting to money Multifamily or Mixed-Use residential or commercial property purchases, Dime can help provide term loans that best meet your needs.

Commercial property is a big tent. It covers company leaders who are tired of renting their home or wish to construct something of their own. It also includes designers who provide their communities with new areas to live, work and play. They all require a bank that can offer them financing with terms that make sense and advisors who make it simple.

We have the resources and flexibility to take on jobs across the broad spectrum of industrial realty. Our people have the experience to structure a deal that's the best suitable for your service. And we do it all from start to complete including internal administration, inspections and appraisals for faster service.

Pinnacle is competitive on a nationwide basis in funding construction tasks and purchases of nearly any size. With a robust institutional platform, Pinnacle has actually made success in large, high profile transactions with developers and helped little and middle market business develop or buy their own spaces. Using longer repayment terms than direct funding, Peak's team of commercial home mortgage bankers are placed to fund a broad selection of jobs and provide exceptional, in-house service throughout the life of the loan.

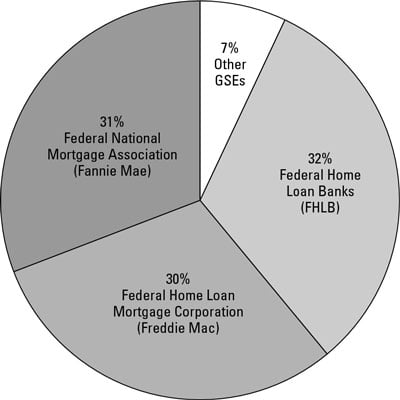

With loans of up to $7. 5 million guaranteed by Freddie Mac, Pinnacle can use flexible terms and payment choices for multifamily owners and investors.

How How Do Reverse Mortgages Work After Death can Save You Time, Stress, and Money.

The typical misunderstanding when buying a live/work home is that the mortgages are more costly. This simply isn't the case. Live/work is not a popular residential or commercial property term and it is unlikely many prospective buyers know what it suggests. Step into any local high street bank and it soon ends up being clear that a lot of the personnel are not familiar with the term live/work themselves.

Rather simply some banks lend on live/work residential or commercial properties and some do not. Some have rules on the % split of live/work homes and some do not. As the mortgage market changes weekly, it may be possible to find a bank that will lend on a live/work property and although it may be the most competitive loan provider one week, it may not be the next week.

Although a premium will not be contributed to the home loan, a smaller sized pool of home mortgage lenders are on deal to buyers and for that reason a smaller sized selection of mortgage products. The two issues live/work home buyers require to be familiar with are: Selecting a lender that will accept lend on the property Ensuring the case is handled by an underwriter who is familiar with the term live/work and understands that the bank they work for are happy to lend on them If a buyer wishes to invest in a live/work home with a mortgage it is essential the best monetary advice is sought to make sure a suitable lending institution is chosen.

They have been encouraging and setting up home mortgages for over 30 years. Please call us today on e-mail us on or complete the form listed below and will call you. We take your personal privacy seriously. Personal data submitted to Prudell Ltd with this type will be treated in accordance with the General Data Defense Guideline 2016 and the Data Security Act 1998. A reverse home loan is a method for property owners ages 62 and older to take advantage of the equity in their house. With a reverse mortgage, a homeowner who owns their house outright or at least has significant equity to draw from can withdraw a portion of their equity without having to repay it up until they leave the house.

Here's how reverse home mortgages work, and what property owners considering one need to know. A reverse home loan is a kind of loan that enables house owners ages 62 and older, normally who've paid off their mortgage, to borrow part of their home's equity as tax-free earnings. Unlike a routine mortgage in which the homeowner makes payments to the lending institution, with a reverse home loan, the loan provider pays the property owner.

Fascination About How Do Reverse Mortgages Work

Supplementing retirement income, covering the cost of required home repairs or paying out-of-pocket medical expenses are typical and acceptable usages of reverse mortgage profits, states Bruce McClary, representative for the National Structure for Credit Counseling." In each scenario where regular income or offered cost savings are insufficient to cover costs, a reverse home mortgage can keep elders from turning to high-interest credit lines or other more expensive loans," McClary states.

To be eligible for a reverse mortgage, the main property owner must be age 62 or older. Nevertheless, if a spouse is under 62, you might still be able to get a reverse home loan if you meet other eligibility requirements. For instance: You must own your home outright or have a single primary lien you intend to borrow against.

You should reside in the home as your primary house. You should remain existing on home taxes, property owners insurance and other necessary legal obligations, such as property owners association charges. You should take part in a customer information session led by a HUD-approved therapist. You must preserve your home and keep it in good condition.

There are various kinds of reverse mortgages, and each one fits a different financial requirement. The most popular type of reverse mortgage, these federally-insured home mortgages usually have greater upfront expenses, however the funds can be utilized for any purpose. Although extensively readily available, HECMs are only used by Federal Real estate Administration (FHA)- approved lenders, and prior to closing, all debtors should receive HUD-approved counseling.

You can normally get a bigger loan advance from this type of reverse home loan, specifically if you have a higher-valued home. This home mortgage is not as typical as the other 2, and is typically offered by nonprofit companies and state and city government companies. Customers can only use the loan (which is generally for a much smaller sized quantity) to cover one particular function, such as a handicap accessible remodel, states Jackie Boies, a senior director of housing and bankruptcy services for Finance International, a not-for-profit debt counselor based in Sugar Land, Texas.

Everything about How Canadian Mortgages Work

The amount a property owner can obtain, referred to as the primary limitation, varies based on the age of the youngest borrower or eligible non-borrowing partner, existing rate of interest, the HECM mortgage limit ($ 765,600 since July 2020) and the home's worth - how mortgages work canada. Property owners are follow this link likely to receive a higher primary limit the older they are, the more the home deserves and the lower the rates of interest.

With a variable rate, your choices include: Equal regular monthly payments, offered a minimum of one debtor lives in the residential or commercial property as their main house Equal month-to-month payments for a set duration of months settled on ahead of time A line of credit that can be accessed till it goes out A combination of a credit line and repaired regular monthly payments for as long as you live in the home A mix of a line of credit plus repaired monthly payments for a set length of time If you choose a HECM with a fixed interest rate, on the other hand, you'll receive a single-disbursement, lump-sum payment - how do interest only mortgages work.

The quantity of money you can obtain from a reverse home mortgage relies on a number of factors, according to Boies, such as the existing market worth of your home, your age, present rates of interest, the type of reverse mortgage, its associated expenses and your financial assessment. The amount you get will also be affected if the house has any other home loans or liens.

" Rather, you'll get a portion of that value." The closing costs for a reverse home mortgage aren't cheap, but most of HECM home mortgages Helpful hints permit homeowners to roll the expenses into the loan so you don't need to shell out the cash upfront. Doing this, nevertheless, reduces the quantity of funds readily available to you through the loan.

5 percent of the exceptional loan balance. The MIP can be financed into the loan. To process your HECM loan, loan providers charge the greater of $2,500 or 2 percent of the very first $200,000 of your house's value, plus 1 percent of the quantity over $200,000. The charge is capped at $6,000.

The 5-Second Trick For How Do Home Mortgages Work

Monthly maintenance costs can not surpass $30 for loans with a fixed rate or an every year adjusting rate, or $35 if the rate adjusts monthly. 3rd parties may charge their own costs, as well, such as for the appraisal and home inspection, a credit check, title search and title insurance, or a recording charge.

Rates can vary depending upon the loan provider, your credit score and other factors. While borrowing against your home equity can maximize money for living expenses, the home loan insurance premium and origination and servicing charges can build up. Here are the benefits and drawbacks of a reverse mortgage. Debtor does not require to make month-to-month payments toward their loan balance Earnings can be used for living and healthcare expenses, debt repayment and other bills Funds can assist borrowers enjoy their retirement Non-borrowing partners not noted on the home mortgage can remain in the house after the borrower dies Customers dealing with foreclosure can utilize a reverse mortgage to settle the existing home mortgage, possibly stopping the foreclosure Customer need to maintain the home and pay property taxes and property owners insurance A reverse mortgage forces you to obtain against the equity in your house, which might be an essential source of retirement funds Charges and other closing costs can be high and will reduce the amount of cash that is readily available If you're not sold on securing a reverse home mortgage, you have options.

Both of these loans permit you to obtain against the equity in your house, although lenders restrict the total up to 80 percent to 85 percent of your home's worth, and with a house equity loan, you'll need to make regular monthly payments. (With a HELOC, payments are required when the draw duration on the line of credit ends.) The closing costs and rates of interest for home equity loans and HELOCs also tend to be substantially lower than what you'll find with a reverse home loan.

3 Easy Facts About How Many Mortgages Are There In The Us Shown

This suggests that the company does not extend home loans to non-residents simply planning to use the home sometimes. The main obstacle to getting any home mortgage is proving to the lending institution that you fit its danger profile. That indicates supplying your employment history, credit rating, and evidence of earnings. For U.S.

However things get a little trickier for someone who hasn't remained in the country all that long or doesn't reside in the U.S. many of the time. For instance, how do you show your creditworthiness if you do not have a credit report from the 3 major bureaus: Equifax, TransUnion, and Experian? You have a guaranteed benefit if you have an existing relationship with a global bank with branches in the U.S.

Thankfully, the home loan industry is controlled by big, global banks, so there's a good opportunity you've had accounts with among them in the past. Also, some lenders may want to order worldwide credit reports as a substitute for the 3 significant U.S. credit bureaus. However, this can be a costly process and one that's generally only offered for citizens of Canada, the United Kingdom, and Ireland.

The FHA accepts non-U.S. tax returns as proof of work. Some loan providers will make borrowers go through more hoops than others to get a loan, so you can remove a lot of headaches by determining ones that regularly work with non-U.S. citizens. If you've done company with a worldwide bank that operates here, that's probably the location to begin.

These not-for-profit monetary company tend to provide exceptionally competitive rates and, depending on their place, may have special loaning programs for permit and visa holders. Lots of banks and home loan companies deal standard and FHA home mortgage to non-U.S. residents, supplied they can confirm their residency status, work history, and monetary track record.

8 Easy Facts About How Do 2nd Mortgages Work? Explained

Flexible Options for Financing Multifamily and Mixed-Use Home Loans The Right Option for Your Service Whether your organization has near-term or long-lasting requirements, Dime Neighborhood Bank has the best financing option for your business. If you are aiming to fund Multifamily or Mixed-Use residential or commercial property purchases, Cent can help offer term loans that best meet your needs.

Industrial real estate is a huge camping tent. It covers company leaders who are tired of leasing their property or want to develop something of their own. It also consists of developers who supply their communities with brand-new spaces to live, work and play. They all require a bank that can provide financing with terms that make good sense and advisors who make it easy.

We have the resources and flexibility to take on projects across the broad spectrum of commercial real estate. Our individuals have the experience to structure an offer that's the very best fit for your company. And we do it all from start to end up including in-house administration, examinations and appraisals for faster service.

Pinnacle is competitive on a national basis in financing building and construction projects and purchases of almost any size. With a robust institutional platform, Peak has earned success in large, high profile deals with developers and assisted small and middle market companies build or buy their own areas. Using longer payment terms than direct funding, Pinnacle's group of commercial home mortgage lenders are placed to money a wide range of jobs and offer exceptional, internal service throughout the life of the loan.

With loans of up to $7. 5 million ensured by Freddie Mac, Peak can use versatile terms and payment choices for multifamily owners and financiers.

Fascination About How Do Mortgages Work After Foreclosure

The typical misunderstanding when purchasing a live/work property is that the mortgages are more costly. This simply isn't the case. Live/work is not a popular residential or commercial property term and it is not likely numerous prospective buyers understand what it indicates. Step into any local high street bank and it soon ends up being clear that a number of the staff are unfamiliar with the term live/work themselves.

Quite just some banks provide on live/work residential or commercial properties and some don't. Some have rules on the % split of live/work residential or commercial properties and some don't. As the home loan market changes weekly, it may be possible to find a bank that will lend on a live/work home and although it may be the most competitive lending institution one week, it may not be the next week.

Although a premium will not be contributed to the home mortgage, a smaller sized pool of mortgage lenders are on offer to purchasers and therefore a smaller sized choice of mortgage items. The two problems live/work residential or commercial property purchasers require to be familiar with are: Choosing a loan provider that will concur to provide on the property Ensuring the case is dealt with by an underwriter who is familiar with the term live/work and understands that the bank they work for are happy to lend on them If a buyer desires to purchase a live/work property with a home loan it is crucial the best monetary suggestions is looked for to ensure an appropriate lender is selected.

They have actually been encouraging and organizing home loans for over 30 years. Please call us today on e-mail us on or finish the kind listed below and will call you. We take your personal privacy seriously. Individual information submitted to Prudell Ltd with this type will be dealt with in accordance with the General Data Protection Guideline 2016 and the Data Protection Act 1998. A reverse home loan is a way for house owners ages 62 and older to leverage the equity in their house. With a reverse home loan, a property owner who owns their house outright or at least has significant equity to draw from can withdraw a portion of their equity without needing to repay it up until they leave the house.

Here's how reverse home loans work, and what homeowners thinking about one requirement to understand. A reverse home loan is a kind of loan that enables house owners ages 62 and older, usually who have actually paid off their mortgage, to obtain part of their house's equity as tax-free income. Unlike a routine mortgage in which the property owner pays to the lender, with a reverse home loan, the lender pays the homeowner.

The Buzz on Obtaining A Home Loan And How Mortgages Work

Supplementing retirement earnings, covering the expense of needed home repair work or paying out-of-pocket medical expenditures prevail and appropriate usages of reverse home loan profits, says Bruce McClary, representative for the National Structure for Credit Therapy." In each circumstance where regular income or available savings are inadequate to cover expenses, a reverse home mortgage can keep senior citizens from relying on high-interest lines of credit or other more costly loans," McClary says.

To be qualified for a reverse mortgage, the main property owner needs to be age 62 or older. Nevertheless, if a partner is under 62, you might still be able to get a reverse mortgage if you satisfy other eligibility requirements. For example: You must own your house outright or have a single main lien you intend to borrow against.

You need to live in the home as your main house. You need to remain existing on real estate tax, homeowners insurance coverage and other necessary legal responsibilities, such as homeowners association dues. You need to get involved in a customer information session led by a HUD-approved counselor. You should maintain your property and keep it in great condition.

There are different types of reverse home mortgages, and every one fits a different monetary need. The most popular type of reverse mortgage, these federally-insured home loans typically have greater in advance expenses, however the funds can be utilized for any purpose. Although extensively available, HECMs are only offered by Federal Housing Administration (FHA)- authorized lending institutions, and prior to closing, all debtors must get HUD-approved counseling.

You can normally get a bigger loan advance from this kind of reverse mortgage, particularly if you have a higher-valued home. This home mortgage is not as common as the other 2, and is typically provided by not-for-profit organizations and state and regional federal government firms. Debtors can just use the loan (which is normally for a much smaller sized amount) to cover one particular function, such as a handicap accessible remodel, says Jackie Boies, a senior director of real estate and personal bankruptcy services for Money Management International, a nonprofit financial obligation counselor based in Sugar Land, Texas.

Rumored Buzz on How Does Payment With Mortgages Work

The quantity a property owner can Helpful hints borrow, called the principal limitation, varies based on the age of the youngest customer or eligible non-borrowing spouse, existing interest rates, the HECM home loan limit ($ 765,600 as of July 2020) and the home's value - how do jumbo mortgages work. Homeowners are most likely to receive a greater primary limit the older they are, the more the home is worth and the lower the rate of interest.

With a variable rate, your choices include: Equal monthly payments, supplied a minimum of one borrower lives in the home as their main house Equal month-to-month payments for a fixed duration of months settled on ahead of time A line of credit that can be accessed till it runs out A combination of a credit line and fixed month-to-month payments for as long as you reside in the house A combination of a line of credit plus fixed monthly payments for a set length of time If you select a HECM with a fixed rates of interest, on the other hand, you'll get a single-disbursement, lump-sum payment - how to reverse mortgages work.

The quantity of money you can obtain from a reverse mortgage relies on a variety of factors, according to Boies, such as the existing market worth of your home, your age, present interest rates, the kind of reverse home loan, its associated expenses and your monetary evaluation. The amount you get will also be affected if the house has any other home mortgages or liens.

" Rather, you'll get a portion of that value." The closing expenses for a reverse mortgage aren't inexpensive, but most of HECM mortgages permit homeowners to roll the expenses into the loan so you don't have to pay out the cash upfront. Doing this, nevertheless, minimizes the amount of funds available to you through the loan.

5 percent of the exceptional loan balance. The MIP can be funded into the loan. To process your HECM loan, lending institutions charge the greater of $2,500 or 2 percent of the very first $200,000 of your home's value, plus 1 percent of the quantity over $200,000. The fee is capped at $6,000.

The Ultimate Guide To How Do Reverse Mortgages Work In Nebraska

Regular monthly maintenance fees can not go beyond $30 for loans with a set rate or an each year adjusting rate, or $35 if the rate changes monthly. 3rd celebrations may charge their own charges, also, such as for the appraisal and house examination, a credit check, title search and title insurance, or a recording cost.